Test improvements to the Solo app and give us your feedback.

Our improvements include migrating Prepare clients to Solo, mapping Solo categories to tax boxes, viewing and downloading SA103F (Self-employment) Tax Reports, and deactivating Solo clients and their associated businesses.

This article contains a guide to migrating Prepare clients to Solo, and links to articles that explain the other features available in beta testing.

These features are currently in testing, we’ll let you know when they’re available for all users.

- Migrate Prepare clients to Solo

- Map Solo Categories to HMRC Tax Boxes

- View and Download SA103F (Self-employment) Tax Reports

- Deactivate Solo Client and their Associated Businesses

Migrating Prepare Clients to Solo

To migrate a client from Prepare to Solo:

- Go to your Dext Solo client list via the sidebar.

- Click on the name of the client you wish to migrate. Be sure you’ve previously reviewed the client and selected to have it migrated to Solo.

- You will then follow a step-by-step process to move the client to Solo.

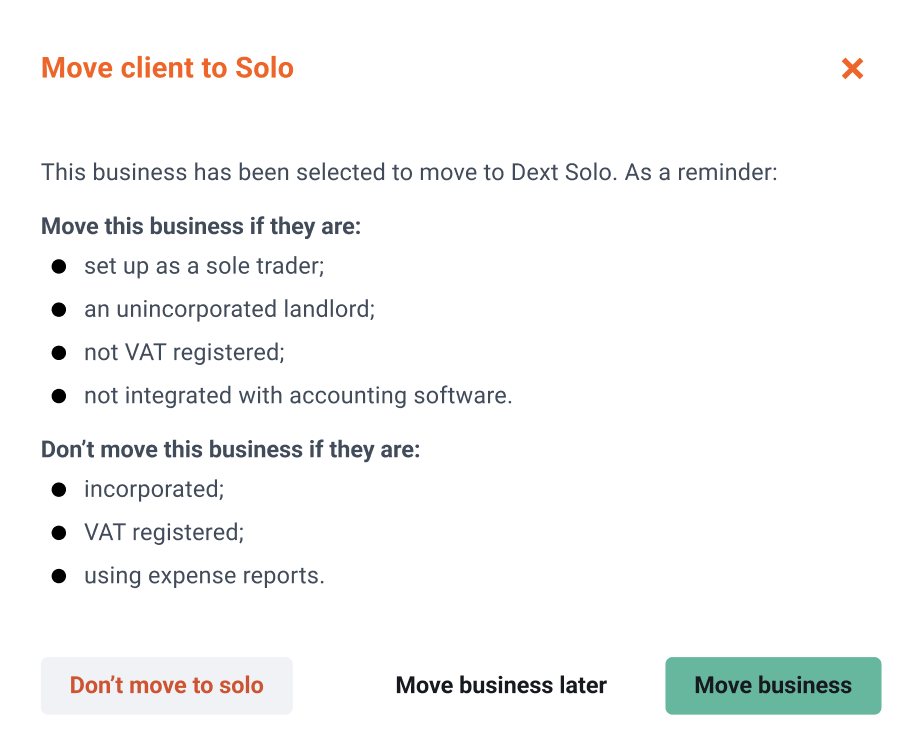

First, review the types of businesses that should be in Solo to ensure the client should be moved there. When ready click Move business.

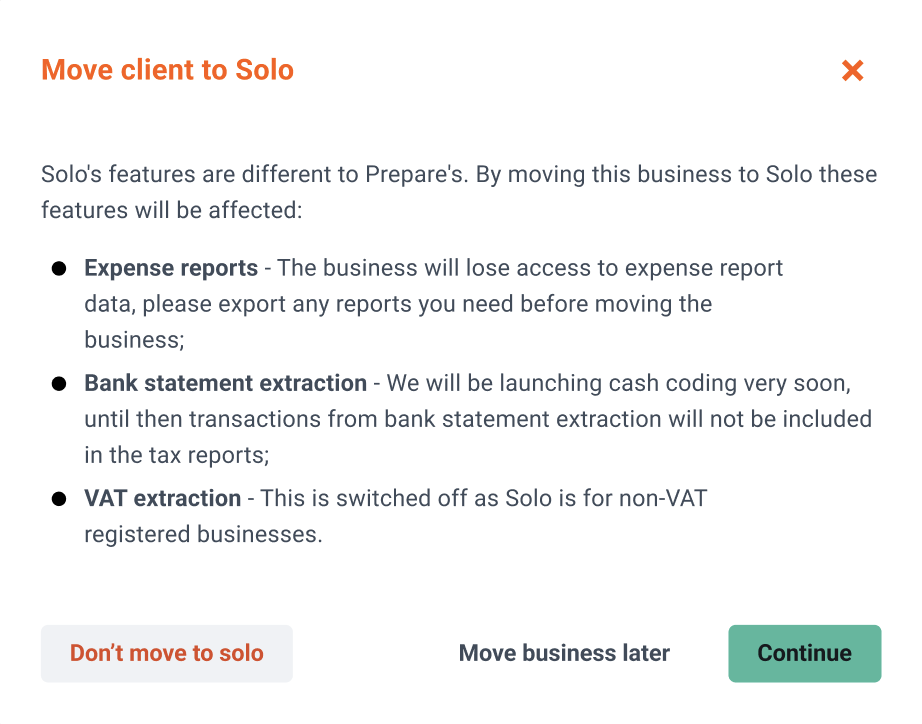

- Review the differences between having a client in Prepare or Solo and the available features and when ready click Continue.

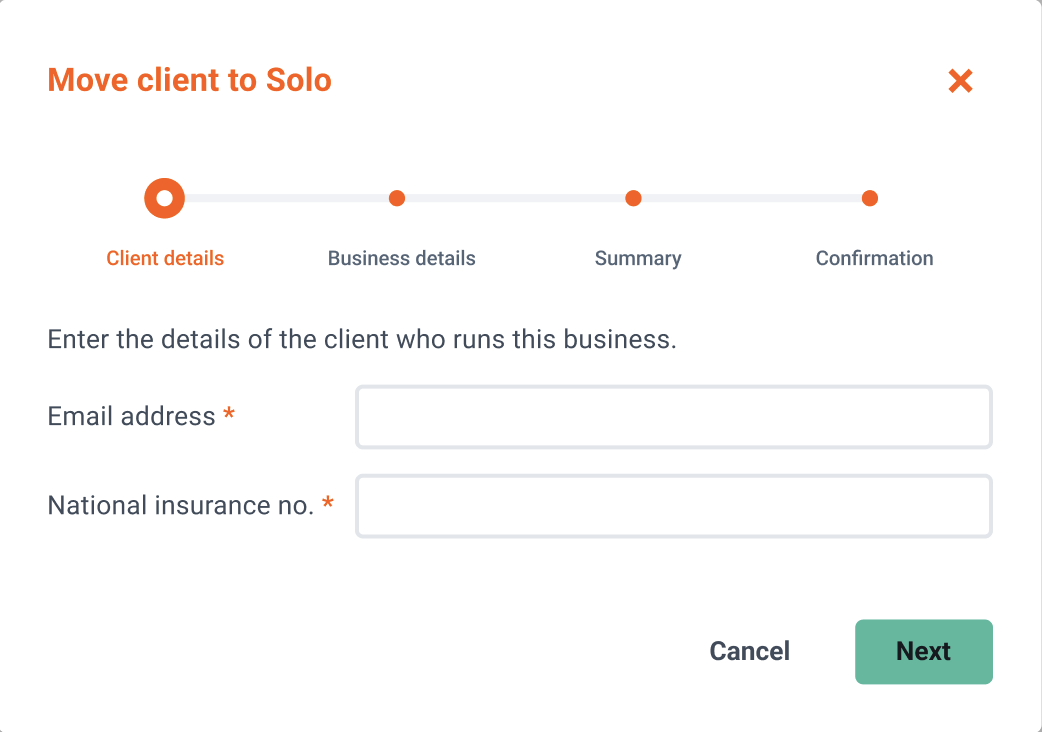

- Enter the client’s email address and National Insurance Number and click Next.

- You will then be directed to one of three flows depending on if the details you entered match a client or user already in Dext Solo:

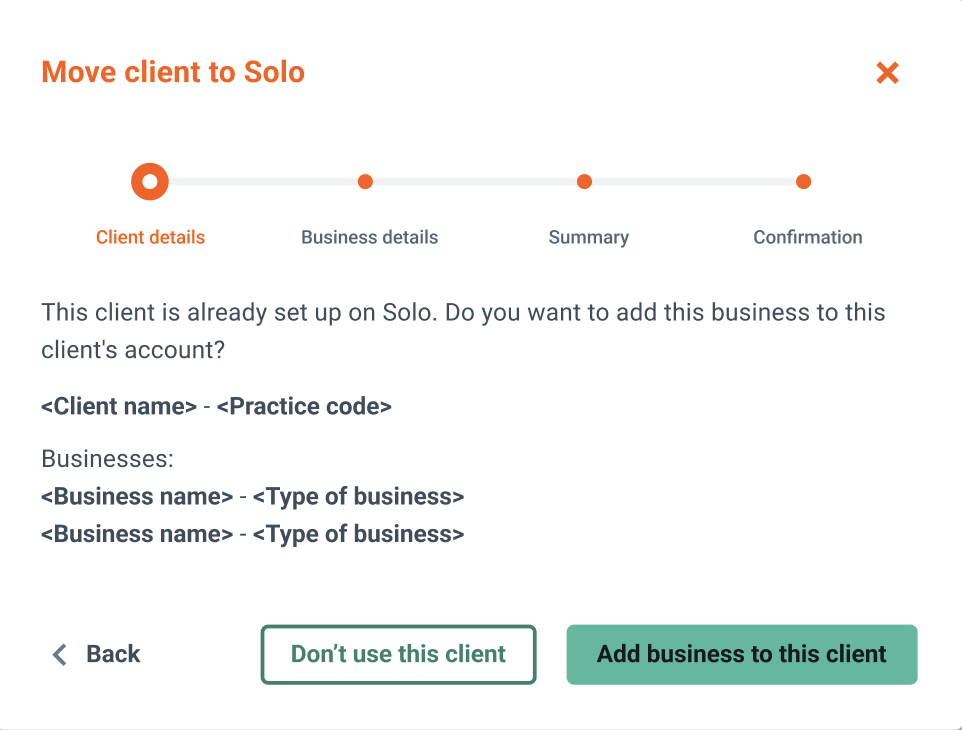

- If the client already exists in Solo you have the option to add the business to their existing businesses by clicking Add business to this client.

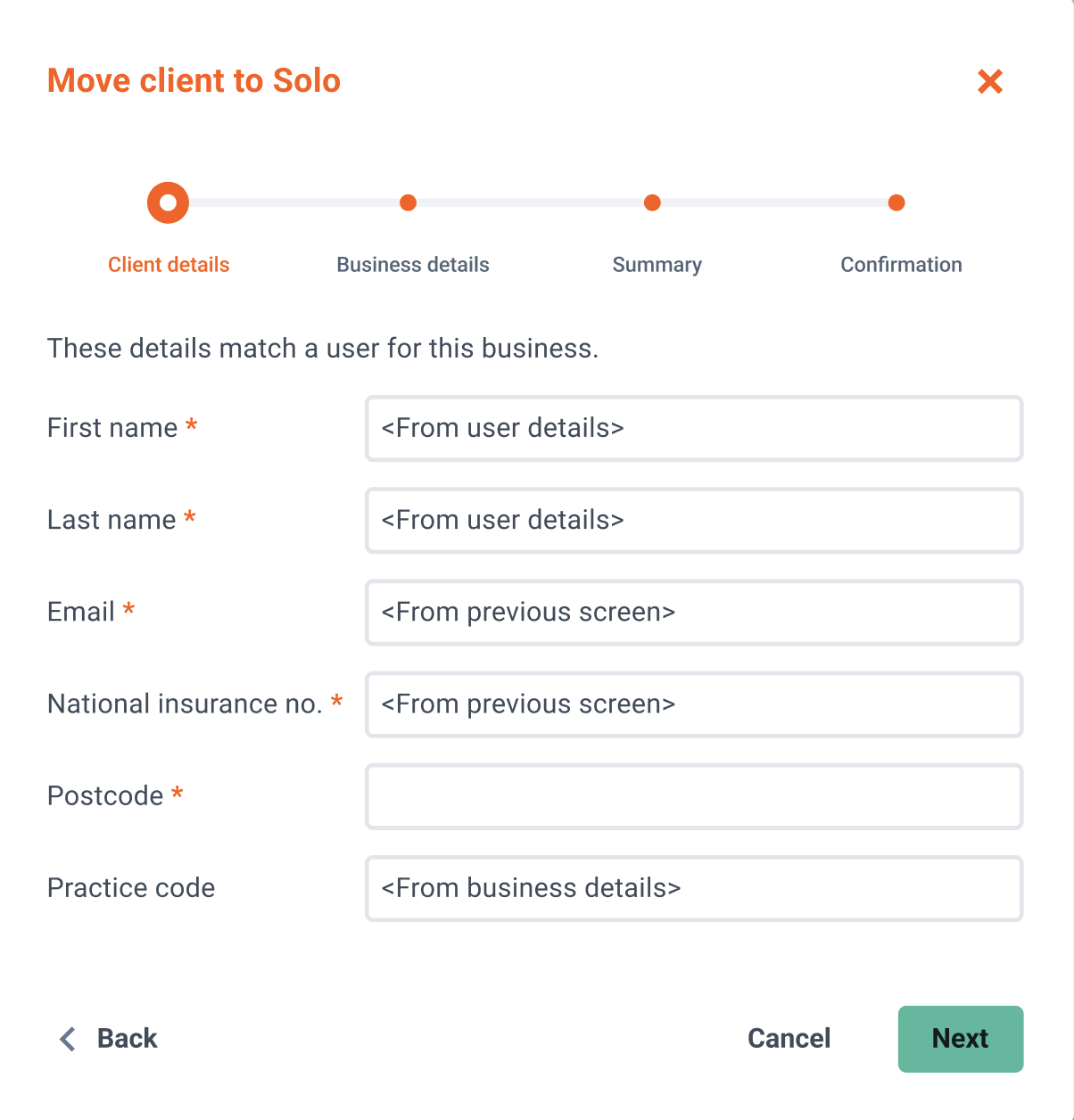

- If the user matches the details of a user in Dext Solo you can give them access to the business you’re moving to Dext Solo. Ensure the details are correct, including the fields pre-populated with the client’s information already held, then click Next.

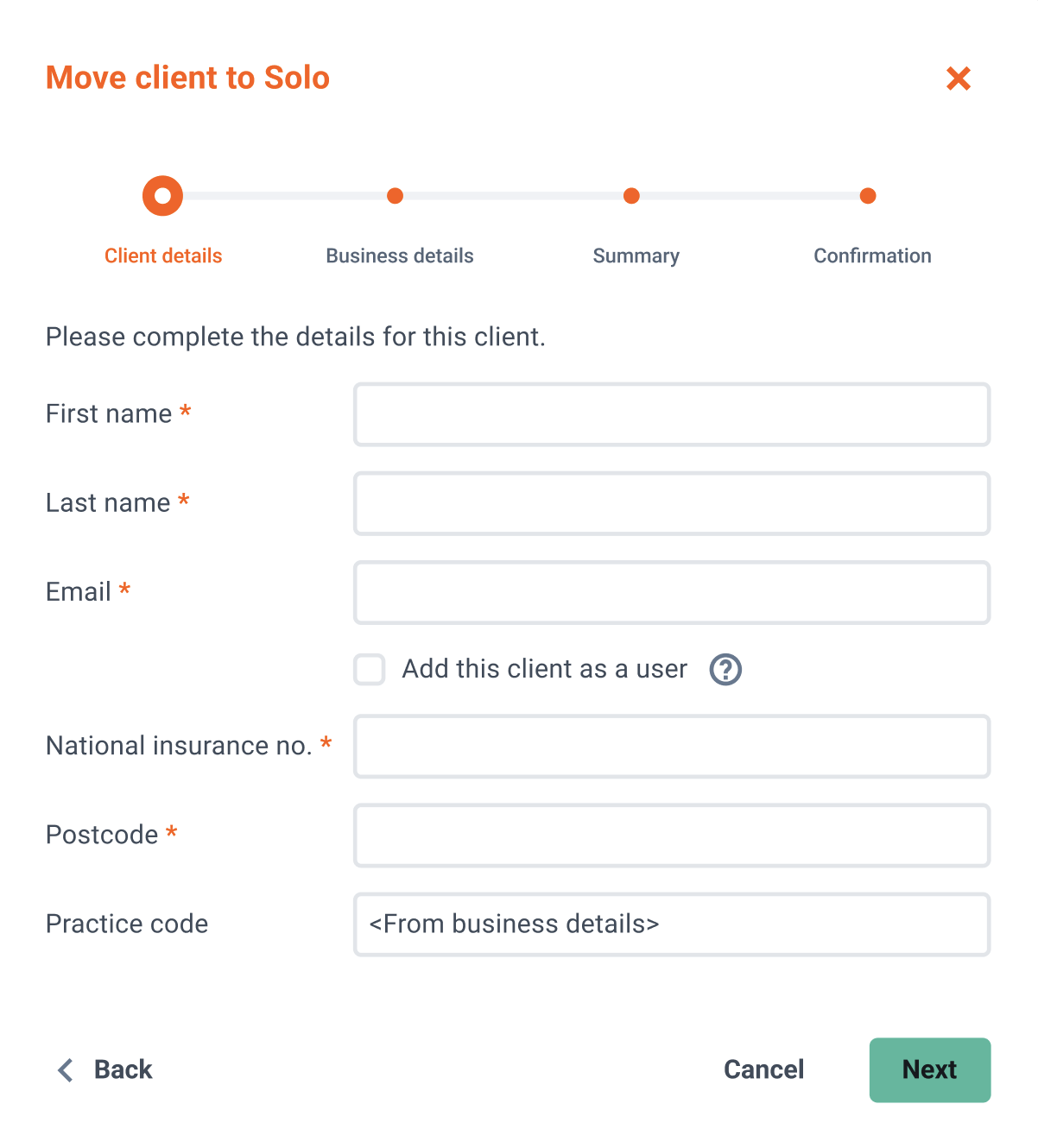

- If there is no client in Solo that matches, you can create a new client by adding the requested information and clicking Next.

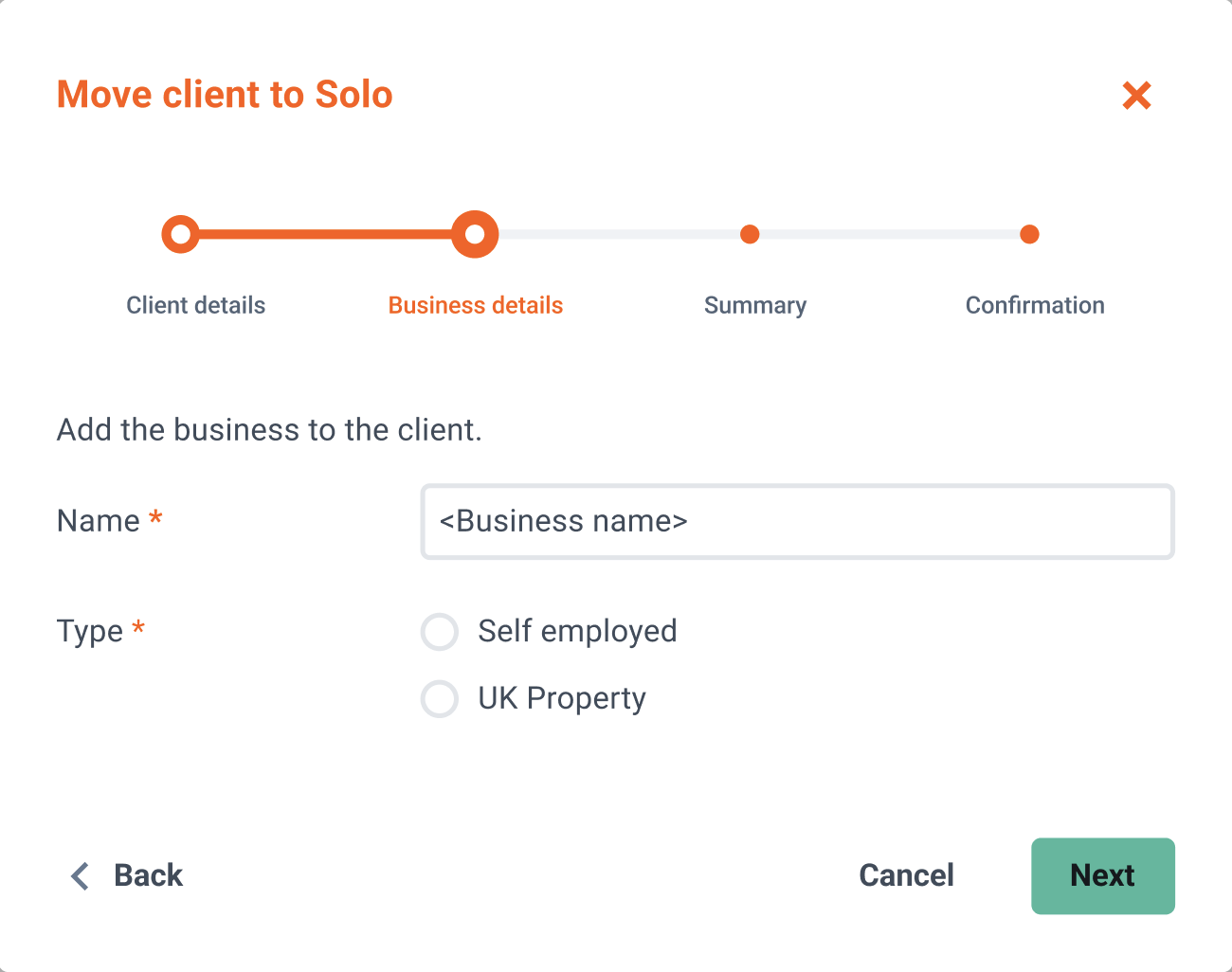

- Next, add a business to the client by entering the business name and selecting the type of business: Self Employed or UK Property. When done click Next.

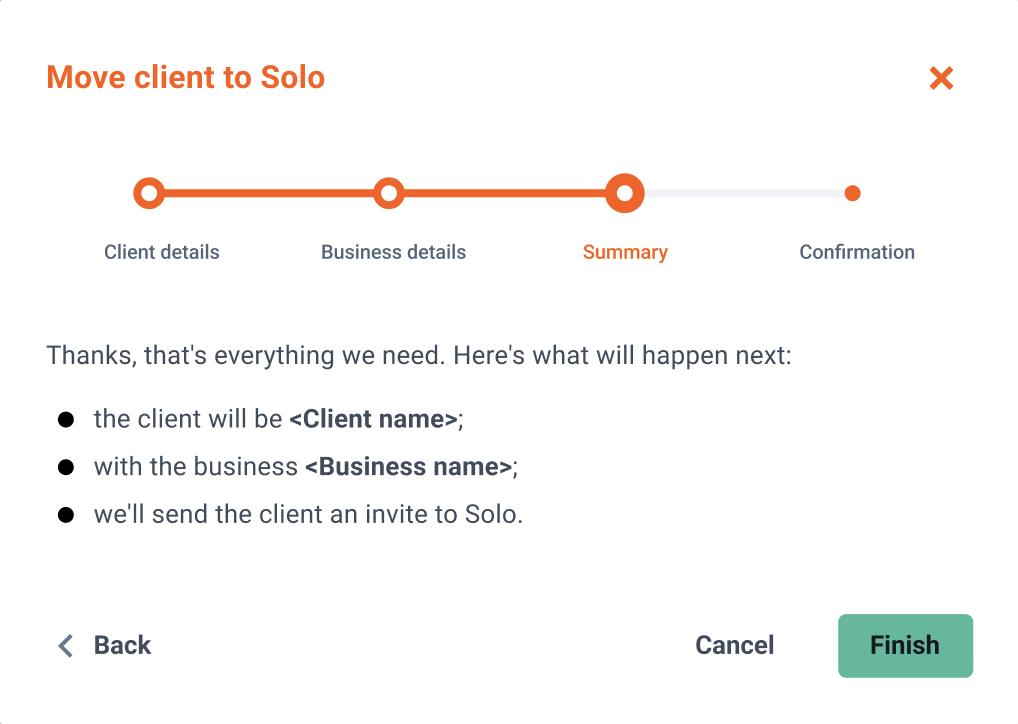

- Review the summary of the next steps and click Finish.