The health check is designed for practices to run through on a regular basis with their clients, ensuring that the books are kept clean and providing value to the client. The process hits a number of touch points to make sure clients are financially prepared as well as highlighting any issues before they become a real problem.

Simply enter in the date range and hit Recalculate to generate the checks.

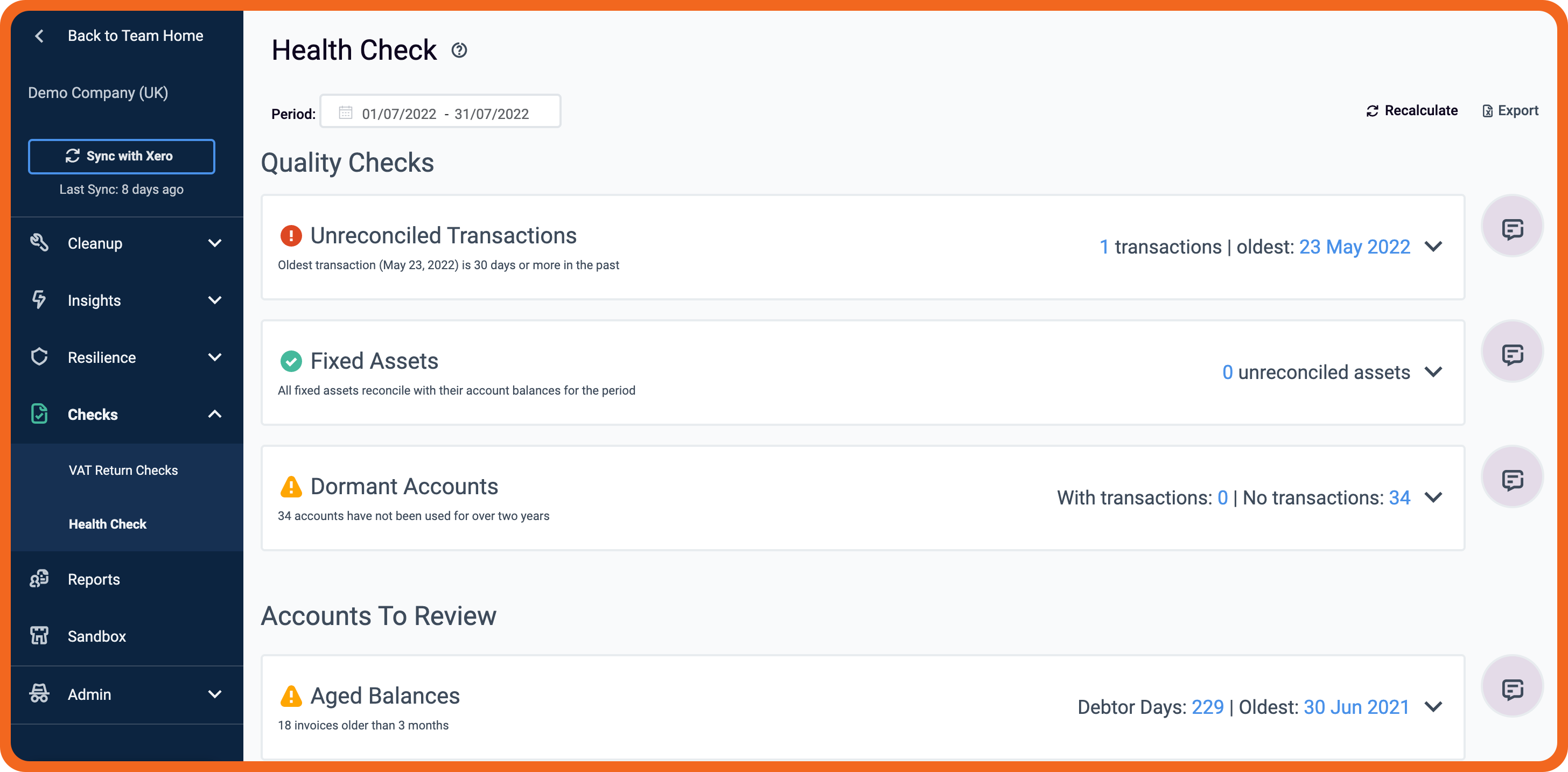

The traffic light system tells you which checks require attention. Key stats are displayed at a glance, and you can click to expand the card and see more detail or head through to the actual insight.

Clicking the speech bubble beside each card will toggle to display some narrative around the purpose of the check, and how to approach it with your client. You can click the speech bubble again to close it.

Unreconciled Transactions

NOTE:

The Unreconciled Transactions check is currently available for Xero clients only.

This uses the same logic as the Unreconciled Transactions insight to find unreconciled transactions for the date range you have supplied, and the age of the oldest unreconciled transaction. The indicator will be amber if there are unreconciled transactions over 15 days old, and red for if there are any over 30 days old.

Fixed Assets

The same as the Fixed Assets insight, but using the end date specified in the Health Check as the fixed asset Reporting Date.

Dormant Accounts

The same as the Dormant Accounts cleanup tool, but using 2 years before the end date specified in the Health Check as the Dormant Since date.

Aged Balances

The same as the Aged Balances insight, but using the end date specified in the Health Check as the Aged Balances Reporting Date. The Invoice Age is fixed to 3 months from the end of the Health Check period.

Draft Invoices

This check looks for invoices that have a status of either DRAFT or SUBMITTED (Awaiting Approval) and have an invoice date that is before the end of the reporting period. Ideally, these should be dealt with before the period is closed off.

Entertainment Accounts

The purpose of this check is to highlight entertainment expenditure across two categories, Staff and Business, each of which have different tax rules. Note: this requires some manual configuration per client to report correctly. The default configuration uses the Xero Reporting Code EXP.ADM.ENT to try and summarise entertainment expenditure in general.

You can change the configuration by clicking the small cog next to the Entertainment Accounts title. Clicking on the Staff Entertainment or Business Entertainment cards will expand to allow you to review the relevant transaction history.

- Staff Entertainment: once the number of employees and the account codes for staff entertainment have been set, this check shows the spend per person since the start of the current UK tax year. Warnings or errors are displayed as the spend per person approaches or exceeds the current HMRC allowable limit of £150.

- Business Entertainment: This check summarises the expenditure during the Health Check Reporting Period for the account codes specified as Business Entertainment. As VAT cannot be reclaimed on this expenditure, this is also summarised for review.

Note: the rules around staff entertainment are specific to UK tax at present.

Multi-coded Contacts

The same as the Multi-Coded Contacts insight, but looking at contacts that have transactions in the reporting period specified.

Regular Suppliers

The same as the Cost Analysis insight, but looking at suppliers active during that period with potential anomalies.

Cost by Account Code

Similar to the functionality in Cost Analysis when in ‘By Account’ mode. Look for anomalies in account movement or as a cost.

PAYE Status

This check balances manual journals against detected payments with PAYE account codes to ensure a correct PAYE status at a point in time. By default, the check calculates the PAYE control account balance based on account codes found under the reporting code LIA.CUR.TAX.OTH. You can change the account codes used by clicking the small cog next to the card title, where Dext Precision will suggest a number of account codes for easy setup. Expanding the card shows the detailed grid of PAYE transaction history for the last 6 months.

The PAYE check runs through the following logic:

- All is well: if the Control Account balance is 0 and there is a Manual or Xero Payroll Journal present in the last complete month

- All is well: the Control Account balance is equal to the amount posted in the Manual or Xero Payroll Journal(s) in the last complete month, and the snapshot date is well in advance of the HMRC Deadline

- Warning: Contol Account and Journals balance, but HMRC payment due date is approaching

- Error: No Manual or Xero Payroll Journal found in the last complete month

- Error: No payment detected, and HMRC payment deadline is past due

- Error: Control Account balance is non-zero and does not reconcile with balance of Manual or Xero Payroll journals

VAT Status

A summary of the VAT Tracking insight reporting on the VAT accrued since the start of the period, and if the annual taxable turnover is within the threshold of your detected scheme.

Estimated Corporation Tax

A summary of the Corporation Tax insight, sharing the next estimated payment for the previous period, and the estimated corporation tax accrued for the current period.

Dividends Status

This check shows a running tally of the dividends posted in the system since the start of the client’s current financial year. The point of this check is to ensure that dividends are declared where necessary from an audit trail perspecitve, and that these intended funds are not being distributed via other channels.

By default, the check retrieves the balance of each control account based on account codes found under the reporting code EQU.RET.DIV. You can change the account codes used by clicking the small cog next to the card title. Expanding the card shows a balance for each of the dividend accounts found. Clicking on a dividend account will display a detailed grid of its transaction history since the start of the financial year.

In terms of status, the Dividends check will show a warning if it is greater than 3 months into the client’s financial year and no evidence of dividends declaration has been found.